In the secondary market, there are only two kinds of money that can be made: 1. The money brought by the growth of the enterprise; 2. The money made from the counterparty through the game (the money transferred from the wealth of the competitor).

The so-called growth money refers to the rise in stock prices due to the growth of corporate performance when the valuation level has not undergone drastic changes. As Charlie Munger said: "In the long run, the annualized rate of return of stocks is roughly the same as the growth rate of its net profit margin, and it is difficult to exceed the latter's growth rate."

In the short-term market, there are always deviations. On the one hand, most investment banks can cover limited stocks. Therefore, many small and medium-sized stocks without analyst coverage may be underestimated due to market neglect. On the other hand, the growth forecast behind this bias is too low, and it can also be an innate bias, such as the environmental protection sector.

On August 12, Yuanchen Technology, a science and technology board stock, released its semi-annual financial report. During the reporting period: the company achieved operating income of 227 million yuan, a year-on-year increase of 26.91%; net profit attributable to shareholders of listed companies was 28.862 million yuan, a year-on-year increase of 293.78% ; The net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses was 25.065.1 million yuan, a year-on-year increase of 418.09%; basic earnings per share were 0.21 yuan.

This is an extremely ideal report card. Not only did the half-year net profit attributable to the parent nearly tripled year-on-year, the growth rate of revenue and net profit in the second quarter of the year was substantially greater than that of the first quarter of the current period or the same period of last year. Growth. Shows the quality of the company's development.

In fact, this semi-annual financial report is a microcosm of Yuanchen Technology’s steady performance during its growth. Looking back on the past five years, it is driven by the pragmatic main business, vigorously developing the non-electricity market, and actively deploying the upstream and downstream industrial chains. , Yuanchen Technology's revenue and net profit continued to grow, drawing a steady growth curve.

Growth has always been the eternal proposition of enterprise development. Looking through the financial report of Yuanchen Technology and the dismantling of its core capabilities are not only the secret of Yuanchen Technology's continuous growth in the past, but also the key to understanding the company's future growth.

1. Consolidate the main business to seize the non-electricity market, and the integrated and in-depth layout shows advantages

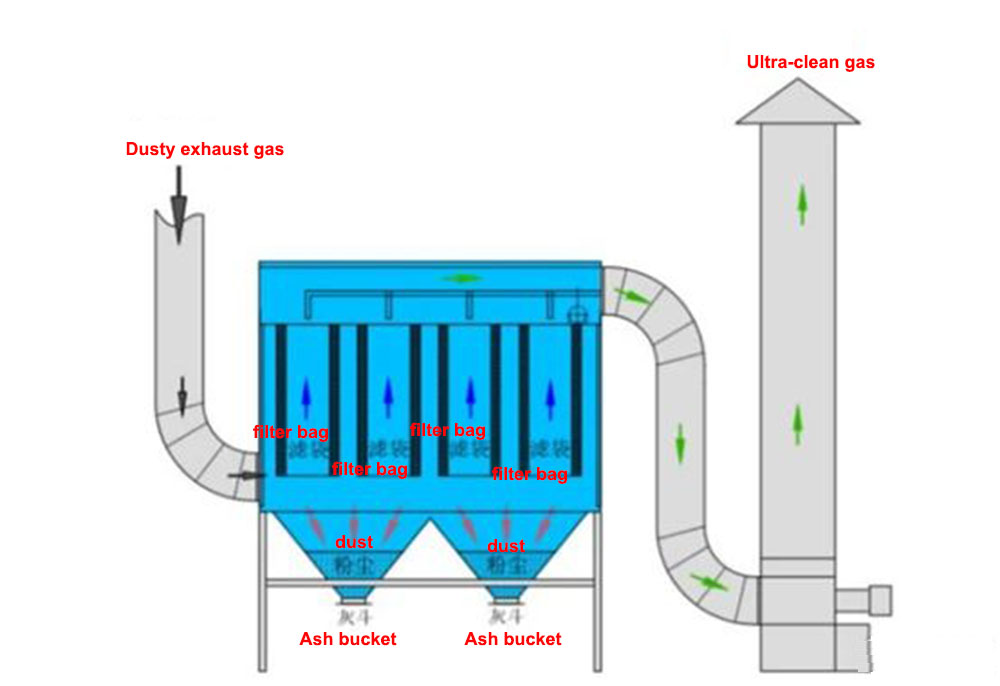

Yuanchen Technology is focused on the research and development, production, sales and service of filter materials and flue gas purification series of environmentally friendly products. The main products are various high temperature and corrosion resistant filter bags and SCR denitration catalysts, which directly contribute to the current carbon-neutral energy development trend.

At present, the products are mainly used in industries and fields such as electric power, steel and coking, waste incineration, cement and glass. The company's main customers are the State Power Investment Corporation, China Power Guorui, Longjing Environmental Protection, Shandong Guoshun, Qingxin Environment, Shougang Jingtang, Sinosteel Tiancheng, Anfeng Iron and Steel, Conch Cement, China Resources Cement and Xinyi Glass.

This year, the State Council issued the "Guiding Opinions on Green and Low-Carbon Cyclic Development", which pointed out that it is necessary to take the lead in making breakthroughs in energy conservation and environmental protection, clean production, clean energy, etc., make a green transition, and establish an industrial structure and energy structure by 2025. , The transportation structure has been significantly optimized, the proportion of green industries has increased significantly, and the green transformation of production and lifestyle goals has achieved significant results, directly providing policy support to environmental protection companies engaged in coordinated pollution reduction and carbon reduction.

According to data, the sources of domestic carbon dioxide emissions are mainly traced to the power industry (40%), industrial energy (38%), construction industry (10%) and transportation (10%). In order to achieve the goal of carbon neutrality, In every field, carbon emissions and carbon footprints need to be reduced in order to achieve carbon neutrality as early as possible. In the process of coordinated pollution reduction and carbon reduction, the use of new materials such as high-efficiency and low-resistance filter bags and ultra-low temperature catalysts is indispensable.

At present, the power industry’s demand for filter bags and denitrification catalysts mainly comes from two parts: incremental and inventory replacement. The incremental demand comes from thermal power equipment that has not completed ultra-low emission transformation and new thermal power equipment, and the demand for inventory replacement comes from completed Subsequent replacement of ultra-low emission retrofit equipment.

In this context, Yuanchen Technology has consolidated its main business and vigorously explored the non-electricity market. From 2017 to 2020, the company's main products accounted for 90.39%, 74.76%, 57.64% and 39.76% of the electricity industry revenue respectively. This is not the shrinking of the power-side business, but the normal performance of the expansion of the scale of revenue brought about by the continuous expansion of the non-electric field, which shows that the non-electric market has become an increasingly important growth point for the company.

According to the disclosure in the interim report, Yuanchen Technology is closely following the national environmental governance policy and complying with the emission control requirements. While continuously consolidating its position in the power market industry, the company has also increased non-electricity projects such as iron and steel sintering, lime kilns, refractory kilns, and garbage incineration. The industry’s market investment has been strategically cooperated with well-known companies such as Shandong Guoshun Group, Everbright Environmental, Shanghai Kangheng Environmental, Huaxing Oriental, Conch Cement, etc., to seize the high-temperature high-end filter bag market. The above-mentioned industries are the high value-added product directions of the company's non-electrical market strategy development, combined with the company's pure PTFE production line capacity expansion, is the main direction to expand the market scale and increase the market share.

According to data, from 2020 to 2022, the annual compound growth rate of the non-electric industry bag filter media market will be at least 15%, reaching 7.2 billion yuan, 8.3 billion yuan and 9.6 billion yuan respectively. According to the prospectus quoted by Polaris Atmosphere Network, the market size of out-of-stock catalysts for non-electric industries will reach 3.5 billion, 4 billion and 4.6 billion respectively from 2020 to 2022.

Compared with the reduction of pollutants in the thermal power industry, the non-electricity industry has an increasing impact on my country’s pollution emissions, and there are more than 400,000 coal-fired boilers distributed in my country, and heating in urban villages, urban-rural junctions and rural areas. The amount of coal used is even more alarming. Among them, the emissions of flue gas dust and NOx account for more than 3/4 of the country. During the coming 14th Five-Year Plan period, environmental protection policies are bound to promote the further development of the non-electricity industry flue gas treatment market. my country's atmospheric governance market has shifted from the gradual maturity of the power industry to the in-depth governance of the non-electricity industry. The non-electricity industry will become the key to winning the "Blue Sky Defense" in the next stage.

Based on the data from 2017 so far, the annual compound growth rate of Yuanchen Technology's non-electricity industry operating income has exceeded 130%. It is worth mentioning that the non-electricity market has a lot to do with the general trend of carbon neutrality.

Another point is to actively lay out the upstream and downstream industrial chain, deriving from the concept of catalyst life-cycle management in the testing center to third-party testing services, forming a second growth point.

Yuanchen Technology established a wholly-owned subsidiary, Cornfield, and rapidly expanded the field of testing within two years. At present, it has developed into a third-party testing company and comprehensive technology service provider in the field of ecological environment and environmental protection.

First of all, the testing industry is an independent third-party service industry, and its business development needs to obtain the corresponding qualification license. In my country, it is necessary to apply for measurement certification review to the local supervisory authority to engage in the testing business, which has certain barriers. At the same time, it must meet various conditions such as brand, capital, and market sales channels.

Yuanchen Technology has its own unique advantages when it enters this field. He is an expert in the field of environmental protection, has top-level customer resource development and own sales channels, and has more than 40 technicians. His laboratory has obtained CMA qualification and CNAS qualification certification, directly opening up various restrictions in the testing industry.

According to the interim report, the company has comprehensive testing qualifications and technical reserves, has built a sales network that combines mobile Internet and offline, and obtains revenue and profits by providing customers with standard, efficient and professional testing services. At present, it is building a whole-process information transmission technology platform for sampling, testing, data analysis, and report release, continuously improving laboratory automation, informatization and intelligence, and improving sampling, sample pre-processing, data analysis and information transmission capabilities, so that the company Able to respond quickly to customer needs, and market competitiveness continues to improve.